Message From the Board

Welcome to our 28 annual report, the Board of Directors is excited to share this with the shareholders, together with managements report on the company’s business performance and future outlook.

During FY25, your company has shown its resilience amidst increasing global supply chain uncertainty, caused by military conflicts in Europe and Middle East, deteriorating relationship with China and a looming tariff war US is waging with several of our key export markets. Management team has steered your company through these uncertainties to deliver a good financial outcome, and set the company on a robust growth path over the next 3-5 years. We encourage you to read this report in detail for understanding our growth plans and strategy.

From Vision To Vogue

Squantic was born from a simple yet powerful idea: fashion should be fearless, expressive, and globally inspired. What started as a passion project has grown into a bold, contemporary clothing brand with a worldwide presence. With every stitch, we honour our roots while embracing the future of fashion—clean lines, purposeful design, and an inclusive spirit.

Message From Our CEO

Your company has shown a robust growth over the last 12 months, 15% higher than the planned revenue, and a significant improvement in margins. My management team is committed to delivering higher level of growth and margin in the next 3-5 years, and are taking some concrete steps to address market uncertainties that exist.

We have embarked on a significant digitalisation drive across our core business and support functions, including Finance and Procurement. We are diversifying our manufacturing base to newer markets in Brazil, India and Thailand, and are

looking to penetrate in high growth markets in India, China, Spain, Brazil and Argentina, while maininting our market share in developed markets.

We are confident of achieving 9% or higher CAGR over the next 5 years.

Business Performance FY25

Revenue Growth

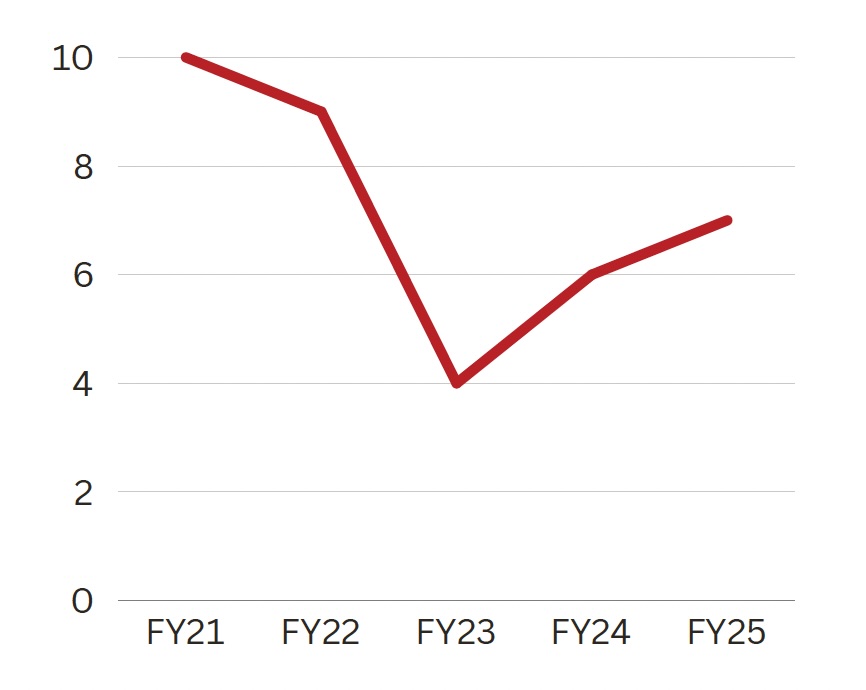

7% growth rate in a market where our competitors degrew by 5% YoY on an average, driven primarily by growth in emerging markets

Cost Savings

Our operating profit grew by 16% on account of a more efficient marketing spend ROI delivered by our Marketing Director, and cost control measures executed by our CFO

Setting Growth Course

We are investing heavily in e-commerce capabilities in India, and in consolidating support functions in low cost high talent pool location in India

Revenue Drivers

Our fastest growing markets continue to be in Asia, and a few such as Spain, across Europe. North America is showing a reduced pace of growth driven by tariff related uncertainties and a perceived inflationary pressures. We expect such conditions to persist over the next 24 months.

We have seen robust growth opportunities in apparels for teens, a segment led by companies such as Zara, Brandy Melville, H&M, GAP and Hollister. Our SVP of Marketing for APAC, Sam Coolman is taking charge of the new division and relocating to Madrid to drive this business segment.

Cost Drivers

Several of our competitors are using lower cost locations such as Poland, India, South East Asia and Puerto Rico for their Global Capabilities Center. After a feasibility study done by EY, we have selected India as our chosen location for setting up a 1,500 employee GCC, starting with Finance and Procurement functions. Our CFO is leading the charge on that, and is in the process of selecting the right service provide to drive this initiative.

Led by McKinsey and Co. study, we have decided to invest heavily in creating e-commerce platform across some of our key emerging markets, starting with India and Brazil. Our Channel Development Team and Marketing Team are working together to drive this initiative, and we expect to start seeing results by Q3 of FY26. This will save us 25% in gross margin vs selling our merchandise on Amazon and other e-commerce platforms.

Summary Of Business Results FY25

The table below summarises the business performance for FY25. These have been summarised from the financial statements audited and signed off by our external auditors – Another Big 4 LLP. Detailed financial statements are available to our investors, and have been emailed to your registered address. If you want to obtain a copy of the audited financial statements, please reach out to Investor Relations team at investors@squantics.com.

| Particulars (Amounts in USD million) |

Q1 FY25 |

Q2 FY25 |

Q3 FY25 |

Q4 FY25 |

Total FY25 |

Total FY24 |

YoY | YoY % |

|---|---|---|---|---|---|---|---|---|

| Revenue from Operations | 725 | 819 | 689 | 775 | 3008 | 2812 | 196 | 7% |

| Direct Material Costs | 295 | 340 | 290 | 322 | 1247 | 1150 | 97 | 8% |

| Employee Costs | 104 | 118 | 101 | 112 | 435 | 421 | 14 | 3% |

| Marketing and Advertising | 51 | 55 | 55 | 49 | 210 | 232 | -22 | -9% |

| Office Expenses | 88 | 95 | 86 | 90 | 359 | 341 | 18 | 5% |

| Travel and Administration | 21 | 34 | 18 | 16 | 89 | 86 | 3 | 3% |

| Other Expenses | 18 | 23 | 15 | 12 | 68 | 64 | 4 | 6% |

| Operating Profit | 148 | 154 | 124 | 174 | 600 | 518 | 82 | 16% |

| Operating Profit as a % of Revenue | 20% | 19% | 18% | 22% | 20% | 18% | ||

| EBITA (inclusive of other income) | 156 | 163 | 136 | 185 | 640 | 556 | 84 | 15% |

| EBIDTA as a % of Revenue | 22% | 20% | 20% | 24% | 21% | 20% | ||

| Net Profit | 115 | 116 | 107 | 134 | 472 | 417 | 55 | 13% |

| Net Profit as a % of Revenue | 16% | 14% | 16% | 17% | 16% | 15% |